list of deductible business expenses pdf

PdfFiller allows users to edit sign fill and share their all type of documents online. Individuals not their businesses and so isnt a business expense.

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Receipt Organization Printable Planner Tax Printables

This publication discusses common business expenses and explains what is and is not de-ductible.

. For the 2020 tax year you could deduct interest expenses up to an amount equal to 50 of your taxable income. An indirect expense is an expense incurred by a firm that is not directly related to the core business operations. Are deductible up to 25 per person.

Ad FreshBooks Is the All-In-1 Tool That Lets You Track Expenses and Build Reports Easily. A Schedule C or Schedule C-EZ which is used to record itemized business deductions. You cant deduct unrelated business.

Ad Integrate book keeping with all your operations to avoid double entry. A 1040 or 1040 EZ which is the master tax return prepared with information from the 1099 and. Start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business but which were incurred before the start of business.

When you take a business trip or send your employees to do the same you may be able to claim. The general rules for deducting busi-ness expenses are discussed in the opening. MEDICAL AND DENTAL EXPENSES You can.

Try for Free Today. Click to print tax deduction checklist for small businesses. Here is an example of a travel expense reimbursement form for the expenses that were incurred during the official travel.

Individuals can deduct many expenses from their personal income taxes. Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client. D educt 50 of the amount that you spend on meals and entertainment.

Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. Federal income tax paid on business income is never deductible. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

The IRS allows you to deduct 5000 in business startup costs and 5000 in organizational costs but only if your total startup costs are 50000 or. Ordinary advertisement and promotional marketing costs related to. State income tax can be deducted on your federal return.

Additionally businesses can deduct credit card fees. For example if you take your client to lunch or a hockey game you can deduct 50 of the cost. Or 5 per square foot standardized deduction.

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Similar deductible business expenses such as commercial rent and utilities. Some expenses are only partially deductible.

In order for an Books Magazines expense to be deductible it must be considered an Business Cards ordinary and necessary expense. To ensure the success of a business indirect expenses must be. A tax deduction commonly referred to as a tax write-off is a business expense used to reduce a companys taxable income and in turn the.

Flyers signage ads branded promo items events or trade shows and the. Create and Send Professional Invoices and Receive Payments Online. This will lower your tax bill by 1000.

Partial Deductible Business Expenses Not all expenses are fully deductible. Now with 54000 in taxable self employment income he pays 8262 in SE tax and 4200 in income tax for a total of 12462. So if you owe 10000 you would only pay 9000.

Below is a list of deductible expenses organized by category. Gift items that cost 4 or. Home office Deduct a percentage of property taxes insurance utilities mortgage interest.

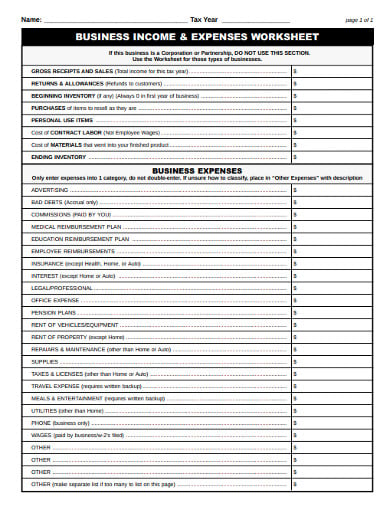

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. The general business expenses are the worksheet that the expenditure and the expenses are included in the sheet. Advertising your tax deductible business expenses.

For the 2021 tax year you can deduct interest expenses up to. Types of Deductible Expenses. Advertising Line 8 Any materials for marketing your business eg.

Now lets say you actually get a refund of 50000 if you add a tax credit instead youll receive 150000. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Through 2022 you can deduct 100 of the cost of qualified property.

Per diem or real expenses for lodging. Per diem or real expenses for meals and. This means tangible property with a recovery period of 20 or less.

Thats 1583 in savings after including the. Top 25 Tax Deductions for Small Businesses. The general business expenses worksheet is for.

Other deductions may have a time limit attached.

Download Pdf Taxes For Small Businesses Quickstart Guide Understanding Taxes For You Small Business Bookkeeping Small Business Tax Small Business Accounting

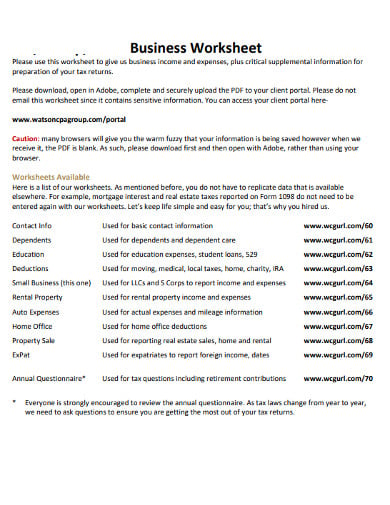

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Personal Assistant Resume Template Resume Writing Personal Assistant Teacher Resume Examples

Unique Start Up Budget Template Xls Xlsformat Xlstemplates Xlstemplate Chec Startup Business Plan Template Business Plan Template Pdf Startup Business Plan

Truck Expenses Worksheet Spreadsheet Template Driving Jobs Printable Worksheets

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Small Business Expenses

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Moving Expenses Spreadsheet Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Marketing Plan Template Statement Template Swot Analysis Template

Are You A Small Business Owner That Has Never Consulted With An Accountant Or Bookkeeper Do You Know W Business Expense Bookkeeping And Accounting Bookkeeping

20 Of The Best Life Organization Printables Business Organization Printables Business Budget Template Free Business Printables

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Happy Planner Finance Planner Printable Planner

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Small Business Tax Business Tax Deductions Business Tax

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Fillable Form 8829 Fillable Forms Form Irs Forms

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

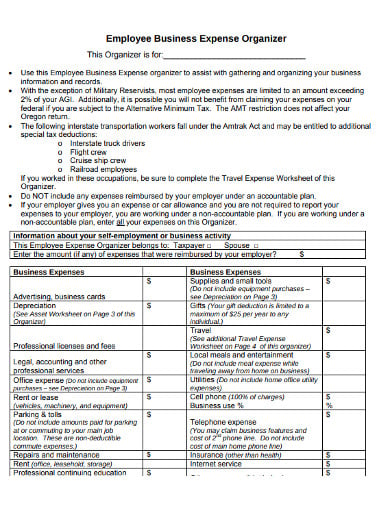

Form 2106 Employee Business Expenses Definition

Inventory Management And Business Expenses Cash Flow Tracker Etsy Business Expense Cost Of Goods Sold Small Business Planner

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Small Business Tax Deductions

Expense Tracking Chart Pdf Form For Download Small Business Expenses Business Expense Tracker Expense Sheet